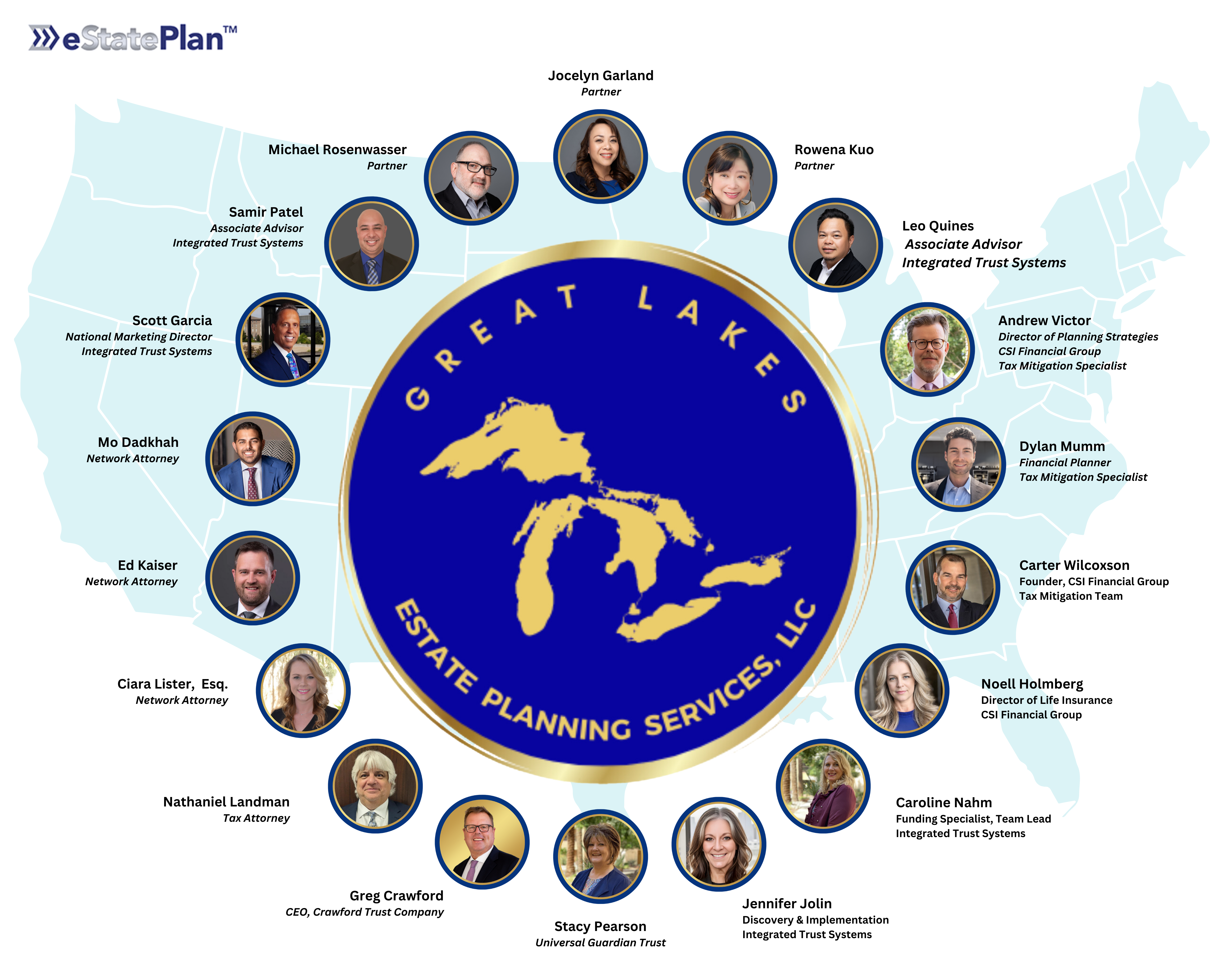

Jocelyn Garland is an Integrated Trust Systems associate advisor and a licensed financial professional. She is a strong advocate of protecting families by preparing for the unforeseen and the inevitable. Her background and almost two decades of experience in physical therapy allowed her to witness the hardship and heartaches that families face when they go through these events in their lives if they don’t have a plan in place.

She and her team reach out to people across the United States from all backgrounds to spread financial literacy. They have helped families establish a better financial foundation and proactively plan courses of action so they can achieve their goals and efficiently pass on their legacy to the next generation. She and her family love their cats and love trying out new cuisine especially when travelling.

Rowena Kuo is an Integrated Trust Systems associate advisor and a licensed financial professional. She is also the author of Author Legacy, Ensuring the Immortality of Your Life’s Work. She is the web talk show host for Don’t Be Cinderella and is a strong advocate of educating families in Financial Literacy.

With a history of being an RN specializing in caring for developmentally different adults, Rowena recognizes the importance of protecting loved ones who may be devastated by the loss of those important to them. Today, Rowena speaks to individuals and businesses about passing on legacies to the next generation. She is also the CEO, Executive Editor, and Producer for Brimstone Fiction, Brimstone Books and Media, and Brimstone Fire. When not working on words or films, she is a full-time mom with secret aspirations for spaceflight.

Michael Rosenwasser is an Integrated Trust Systems associate advisor and had been in the advertising and marketing field for 40 years. He owns a sports memorabilia company and is an avid baseball, hockey, and football fan. He loves to travel and is a food connoisseur.

He has an excellent track record in customer relations and in ensuring that his clients get the best customer service possible. Michael has experienced firsthand the benefits of a seamless legacy transfer from his parents and would like to help a lot of people do the same.

Leo Quines is an Integrated Trust Systems Associate Advisor and a licensed financial professional with a passion to help families build a foundation in financial literacy: Freedom, Independence and Opportunity. Leo has a background in Information Technology (IT) with over two and a half decades of extensive experience and project management skills. He is currently working as an IT consultant with a financial services firm specializing in Fintech. Leo has lost real estate investments during the housing market bubble in 2008. He believes it’s crucial to have a plan for unforeseen events and protecting what you worked hard for.

Samir Patel is an Integrated Trust Systems Associate Advisor and a licensed financial professional with a passion to help families achieve financial freedom. Samir has a background in Finance with over fifteen years of experience working in the healthcare and technology industries. He is currently working as an analyst at a technology firm specializing in automotive software for body shops. Samir has lost family members that have had no financial plan. He believes in educating families on creating a plan for their loved ones to avoid financial burden when the unforeseen happens.

Mo Dadkhah is an attorney born and raised in the Chicagoland area. Mo graduated law school in 2009 and immediately started his Law Practice and Law Firm. He is also the broker owner of Main Street Real Estate Group and for the last fifteen years has focused his attention (and practices) primarily on real estate, corporate law and estate planning. Mo has been named a Top 50 Attorney by the Top 100 Magazine, a Power Player by Chicago Scene magazine, his Firm has been selected as an Inc. 5000 list of fastest-growing companies, and he has been named as a Chicago Agent Magazine Who’s Who for seven consecutive years. He has also held board seats at the Chicago Association of Realtors and been the host of WGN’s Market Overdrive radio show.

Mo brings a wide range of knowledge in estate planning, real estate, and corporate law together to best guide his clients on how to best protect themselves in a complete manner. He prides himself on being honest and transparent, while caring for every client’s needs no matter how large or small their concerns are. Every client’s situation is important and all of their questions/concerns matter.

In his free time Mo loves competing in auto racing, martial arts, and spending time with his family.

Ed Kaiser is an award-winning legal professional with over ten years of multi-jurisdictional and multi-disciplined legal practice. His expertise spans multiple practice areas, including real estate, business law, estates and trusts, litigation, and dispute resolution. As a legal advisor, Ed prioritizes open communication and a personalized approach, fostering strong client relationships built on trust, empathy, and mutual respect. Ed’s clients appreciate his easy-going demeanor and ability to explain complex legal concepts in a clear and understandable manner, empowering them to make informed decisions about their legal matters. Ed’s Trusted Estate Plan, powered by the Integrated Trust Systems platform, offers a unique, user-friendly, self-guided option for establishing a modern, economical, and flexible estate plan. In life, change is inevitable. With the Integrated Trust Systems platform at your fingertips, making changes to your Trusted Estate Plan is simple.

Andrew Auchincloss Victor has been in the financial services industry for 27 years. Working with financial advisors, accountants, and attorneys, he provides counsel in the areas of tax mitigation and efficiency, wealth transfer, estate planning, business succession, and charitable giving. He’s created a proprietary wealth development and tax-management model which has helped over a thousand clients reduce taxes so they can give more to their children and charities versus the IRS.

Andrew graduated from Harvard in 1993 with a bachelor’s degree in government with a focus on Economics. Andrew and his wife Sarah have two sons, Jacob and Jack, and enjoy fly fishing, golf, tennis, and now pickleball.

Dylan Mumm is a financial planner with extensive experience in the analysis of a wide array of financial positioning. An expert in the implementation of Structured Settlements, alternative assets, life insurance and securities positioning, he has spent his career advising attorneys, advisors and their clients on the forecasting and implementation and future management of their assets. Dylan hold his series 65 license as well as life licenses, Dylan’s educational background is in the field of economics from Colorado State University.

Caroline Nahm offers Integrated Trust Systems Advisor Partners and their clients a kind, guiding hand to help them through the process of securing their financial futures. For almost a decade she has worked with one of our key Advisor Partners, refining her skills at client service and managing the workflow for completing important processes.

As an Integrated Trust Systems Funding Specialist, she walks clients through the 7-step process of funding their eStatePlanTM arranging their consultations with eStatePlanTM principals and helping them secure the necessary funding documents to make their plan a success.

Married for 25 years and with two grown sons, Caroline likes to spend her time cooking, reading, exercising and rescuing dogs. Her two newest family members are Kylo, an Australian Shepherd and Obi the Beagle.